Will Bitcoin rise again? Will it impact the Crypto market?

When the price of Bitcoin goes down, the whole crypto market is crashed that’s why miners always look first the behavior of Bitcoin first before going to invest in this market that is very unstable and the chances of your failure become viable.

Definitely, the prices will change bitcoin is facing huge turmoil this year and the factors behind this are obvious, one of the most important factors pushing the Bitcoin price below the par is the war between Russia and Ukraine, the investors, experts, and analysts believe that the price of BTC will go up once the war will over. It depends upon the current situation as well, as per my point of view, Gulf countries have started their support to Russia, it sounds like a new block of countries is emerging that can be, however, a red alarm to the cryptocurrency market, sooner or later, the dominance of BTC may be demolished, it is my point of view that’s why I strongly recommend people to go for small coins.

Experts Say Bitcoin will Touch $100000

It is just like 50-50, some experts say that the Price will touch $100000 this year whereas most of the safe-players deny this, they believe that the after-effects of the war will badly affect the whole financial market and there are a few chances of improvement even if the war is over today. According to Time magazine, some experts showed their views, let’s go through it now.

Late last year, it was easy to predict a $100,000 price for the digital currency, which had just hit an all-time high. The prediction game is even more difficult because of the big fall of Bitcoin. A middle ground might be reached if the most extreme skeptics are to be believed, as they say that Bitcoin will tank to as low as $10,000 in 2022, but can still reach $100,000 in a few years

“The most knowledgeable educators in the space are predicting $100,000 Bitcoin in Q1 2022 or sooner,” Kate Waltman, a New York-based certified public accountant who specializes in crypto, told us back in November 2021.

Major corporations like Nike and other big brands are looking at ways to monetize their products in the digital metaverse, which is why bullish experts are re-examining the cryptocurrencies altogether. The popularity of altcoins is increasing due to the rise of metaverse games, worlds, products, and experiences, which has changed investors’ attitudes about the original coin.

Many experts are hesitant to make predictions about a number and a date, but they point to the trend of Bitcoins increasing its value over time. In October of last year, Jurrien Timmer, director of global macro at Fidelity Investments, predicted that the $100,000 threshold would be reached by the end of the year, and that investors should expect a rise in the long-term value of Bitcoin.

“What I expect from Bitcoin is volatility [in the] short-term and growth [in the] long-term,” says Kiana Danial, founder of Invest Diva and author of “Cryptocurrency Investing For Dummies.”

Here are some more predictions we found, ranked from low to high over the next year:

Ian Balina

- Point of View: Bitcoin investor and founder of crypto research and media company Token Metrics

- Prediction: Bitcoin can go to $100,000-$150,000, but the timeline is unclear

- Why: The total market and other assets are not in a bearish sentiment cycle. When it comes to innovation when it comes to what experts call “Web 3”, which is the new internet built on a new type of ledger called a blockchain, there is only one winner. The release of new altcoins and hype about the metaverse will continue to drive the demand for the coin, and it will eventually bounce back.

Robert Breedlove

- Point of View: Founder and CEO of the digital assets marketing and consulting firm Parallax Digital

- Prediction: $307,000 by October 2021 (now passed), and $12.5 million by 2031

- Why: Breedlove said in an interview earlier this year that inflationary pressures after COVID-19 will drive interest inCryptocurrencies, pushing the value ofCryptocurrencies up higher than previous projections estimated Breedlove is known as more of a philosopher type than a coin enthusiast, but his price predictions haven’t exactly been spot on.

Matthew Hyland

- Point of View: Technical analysis and blockchain data analyst

- Prediction: Bitcoin can reach $100,000 in 2022

- Why: There is a new demand for altcoins, but the price of Bitcoins is almost the same as it was in January 2021. There is an ongoing trend of major exchanges leaving the Crypto market He said a dip below $40,000 could lead to a bear market in the virtual currency.

Why the Bitcoin Price may Go High?

Economic factors such as supply and demand, public sentiment, the news cycle, market events, scarcity, and more all have an influence on the price of cryptocurrencies. Here are some that have been found.

Adoption:

Too much adoption from the people made the Bitcoin price higher, the imbalance in the market caused the reason for the sudden rise of the BTC price.

Cryptocurrencies are being adopted at a faster rate than humans first adopted internet technology. The compounding acceleration of new adoption could push the value of the currency higher and higher. According to data from the digital asset management firm, people have adopted digital currency at a faster rate than the internet has.

The number of new wallets worldwide increased by 45% from January 2020 to January 2021, according to a report last month. A popular exchange says it has over 73 million users, while another recently released its “State of U.S.”. 21.2 million Americans own some kind of virtual currency, according to the report.

Scarcity:

Do you know that there are almost 18 to 19 million Bitcoins are in circulation, and minting will stop at 21 million? This built-in scarcity is a big part of the appeal of cryptocurrency.

There’s a fixed supply but increasing demand,” says Alexis Johnson, president of the blockchain public relations and events company, Light Node Media.

Other experts point out Bitcoin has value because people give it value. “That’s really why everybody’s buying — because of the psychological aspect,” says Nelson Merchan, Johnson’s Light Node Media co-founder. That can make it difficult for the average consumer to discern whether Bitcoin and other cryptocurrencies are legitimate. The whole concept of supply and demand only works when people want something scarce — even if it previously didn’t exist.

“It actually does almost kind of seem like a scam,” Merchan says about Bitcoin’s origins. Though he says he’s seen his crypto holdings reach millions at times since he began investing in 2017, he’s also seen them disappear in an instant.

“I’m a big believer that if it’s not in cash, you don’t really have that money because, in crypto, anything can drop dramatically overnight,” Merchan says. This is why certified financial planners suggest only allocating 1% to 5% of your portfolio to crypto — to protect your money from volatility.

Regulation:

In the last few months, federal officials have made it clear that they are paying attention to the digital currency. According to industry professionals, hawkish federal regulation is one of the main reasons for the lagging price of the digital currency. In a recent interview with First Mover, the managing partner of CoinFund said that the Fed moved to a “hawkish position” on cryptocurrencies just as Omicron started to tick up in the U.S.

There are a lot of unanswered questions when it comes to cryptocurrencies. The president recently signed an infrastructure bill that requires all exchanges to notify the IRS of their transactions. Stable coins are linked to the value of the U.S. and were recently mentioned by Treasury Secretary Janet Yellen. The discussion on regulatory policies is patchy and should be subject to federal oversight, according to an industry white paper. Any new regulation has the potential to affect value with a relatively new asset class.

“[Regulation has] kind of evolved over the last five years,” says Ben Cruikshank, head of Flourish, “Regulators can always change their mind.”

The conversation about regulatory policies is patchy according to an industry white paper published by Flourish. Any new regulation has the potential to impact value with a relatively new asset class. The price of Bitcoin dropped when China banned it in September of 2021, but it has since risen and resumed its usual fluctuations. The Securities and Exchange Commission is taking all decisions on a case-by-case basis in what experts refer to as its “crawl, walk, run” strategy towards mainstream adoption of cryptocurrencies.

Mining Cycles:

A cycle known as halving is one of the biggest influences on the price of digital currency. halving is a step in the mining process that results in the halving of the reward for mining transactions. Halving affects the rate at which new coins enter circulation, which can affect the value of existing Bitcoin holdings. halvings have been correlated with boom and bust cycles in the past.

After a halving event ends, some experts try to predict the cycles down to the day. You should check the Bitcoin price over the years, it will give you an idea about the price fluctuations, you can get the idea from there whether to invest or not.

What Investors Need to Know About Bitcoin Price Projections:

Financial planners and other experts advise against letting price fluctuations lead to emotional decision-making, like with any investment. Studies have shown investors who contribute regularly to passive index funds and ETFs perform better over time, thanks to a strategy called dollar-cost averaging, in which experts recommend not to invest more than 5% of your overall portfolio.

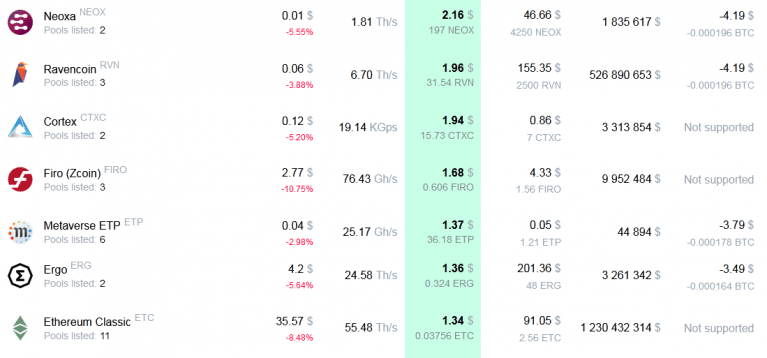

The path to long-term wealth and saving for retirement is most successful for people with diversified investments like low-cost index funds, which make up a small part. If you want to know how to mine Bitcoin you must learn how to build a GPU mining rig and how mining rig works, it will give you an idea about the kind of coins that can be mined on a GPU mining rig, however, you need a mining machine to mine the Bitcoin just because of the complex algorithms that use in the blockchain environment.

According to experts, a set-it-and-forget-it approach is a good way to achieve financial goals. It is ok to wait and see how things play out before putting your money on the line. The value of Bitcoin is highly volatile from day today, and we only have 10 years of data to inform our predictions. It’s hard to know what you’re doing with your digital currency strategy. Ask yourself what you want to achieve from your participation in the volatile market, and why, before investing in any alternative assets. You will be able to stay focused because of that.

“I don’t think people understand across the board how to value [Bitcoin],” says Gutierrez. “When you’re buying it, you need to know your expectation of what value you’re going to get from what you’re buying.”

If a client expresses an interest in learning about it, financial planners don’t have a prejudice against it. However, you should ask yourself if you need it in your plan. In most cases, the answer is not yes.

“Our take is that we don’t think you need Bitcoin in order to reach financial goals,” she says, adding that the average person should favor simple ways of investing that are easy to understand. This will keep you on track for core financial goals and better position you long-term for a healthy retirement.